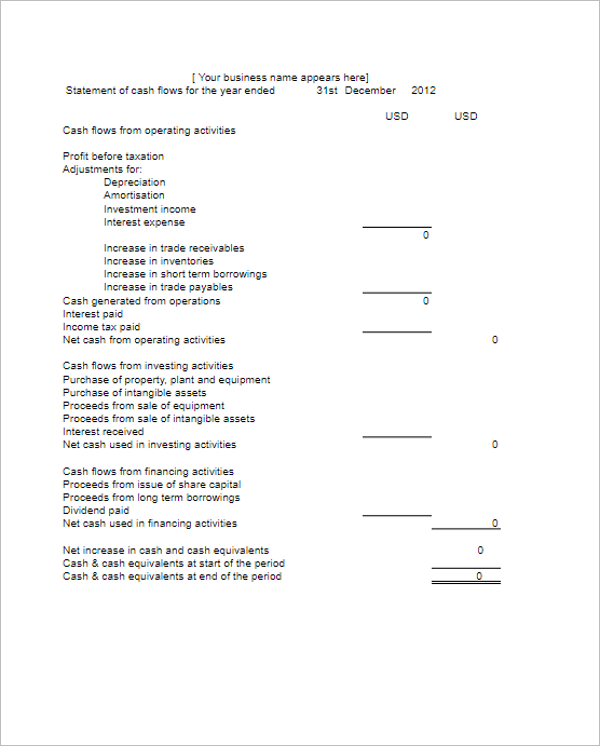

Statement of cash flows proforma pro#

While this provides insight into a company’s historical health, creating pro forma financial statements focuses on its future.

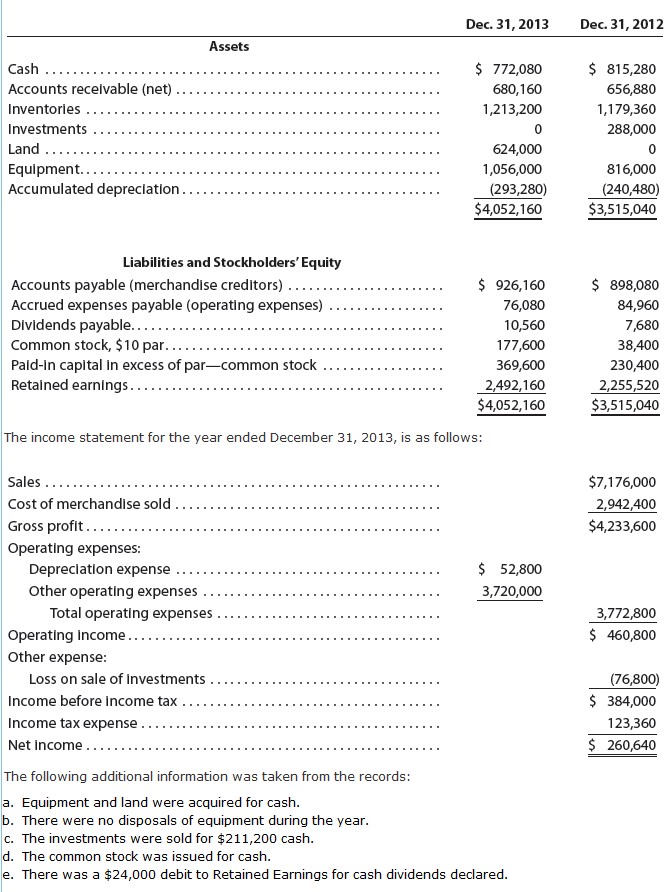

Traditionally, financial statement analysis is used to better understand a company’s performance over a specified period. How Are Pro Forma Financial Statements Used? In fact, business owners, investors, creditors, and other key decision-makers all use pro forma financial statements to measure the potential impact of business decisions. Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. Since the term “pro forma” refers to projections or forecasts, it can apply to a variety of financial statements, including: The course notes that these projections can be used “as a depiction of what the financial statements for the business will look like over a certain period of time, if the assumptions made when preparing them hold true.” They may also be referred to as a financial forecast or financial projection.” In the online course Financial Accounting, pro forma financial statements are defined as “financial statements forecasted for future periods.

Statement of cash flows proforma download#

DOWNLOAD NOWĪ pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasn’t yet occurred. Here’s a closer look at what pro forma financial statements are, how they’re created, and why they’re a key aspect of financial decision-making.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today. Pro forma financial statements are a common type of forecast that can be useful in these situations. For this reason, professionals typically turn to forecasts and financial projections to guide their plans and answer critical “what if” questions. While certain financial statements-such as balance sheets, income statements, cash flow statements, and annual reports-help provide a historical snapshot of a business’s performance, they often lack the ability to provide foresight when planning for the future. To get sign-off from key stakeholders, win investors, and strategically plan, you need to demonstrate that your ideas make financial sense. When it comes to making business decisions, so much relies on numbers.

0 kommentar(er)

0 kommentar(er)